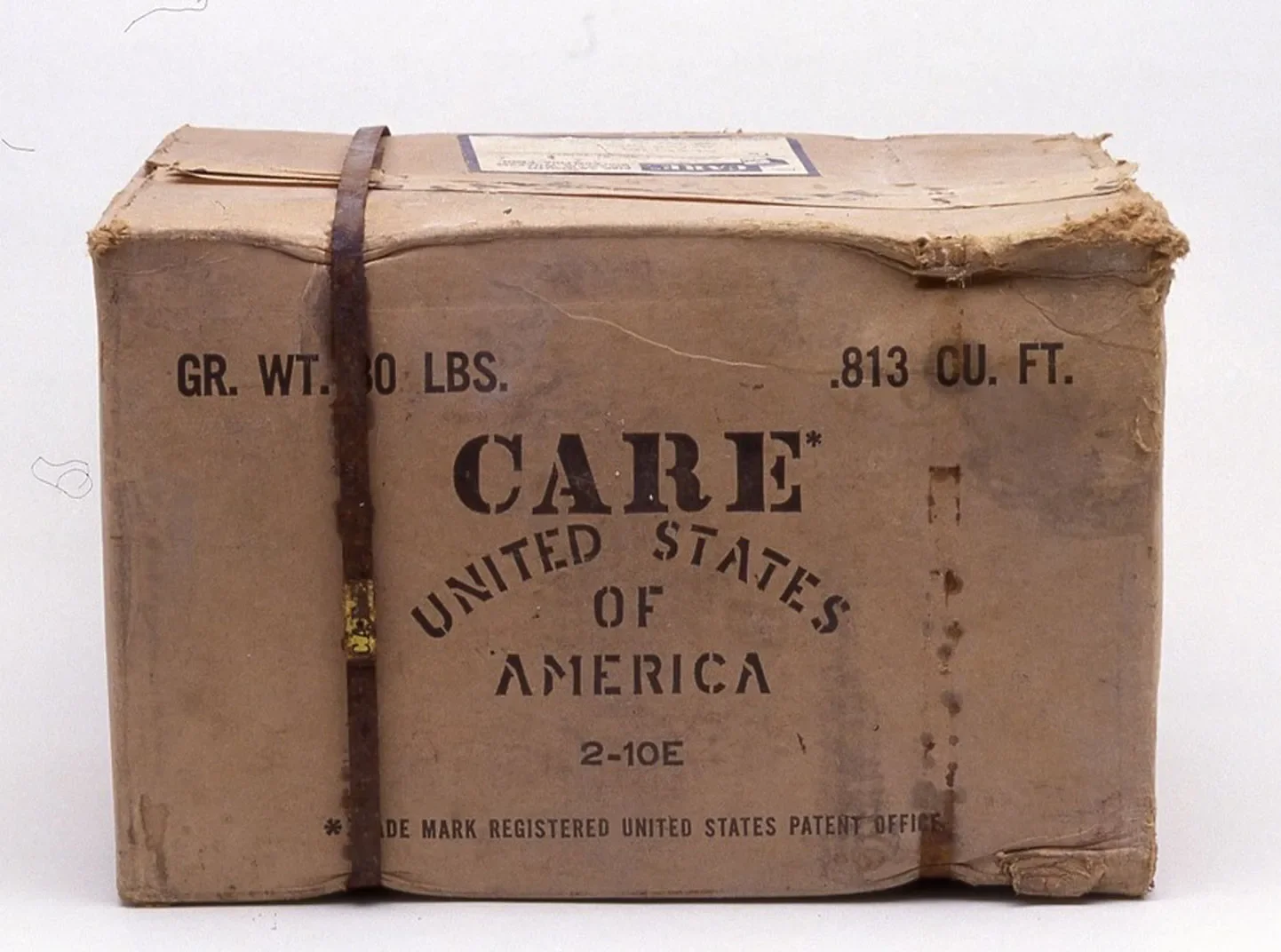

The opportunity

Women-led micro and small enterprises are vital to economies around the world. Yet many are prevented from reaching their full potential due to challenges in accessing finance, harmful social norms, difficulties in reaching markets, and low digital literacy or access to technology. It’s estimated that unlocking the $1.7 trillion global finance gap for women and reducing other barriers could add $5-6 trillion to the global economy.

Investing in women entrepreneurs is not just for social impact; it’s also good business.