NEW YORK (Sept. 19, 2017) — Today, CARE Enterprises Inc. announces its collaboration with the Fourth Sector Development Initiative of the World Economic Forum and its plans to deploy $30 million in patient capital through flexible deal structures to meet the unique needs of for-benefit entrepreneurs that are creating transformative economic opportunity for people living in poverty.

For-benefit enterprises are hybrid business structures whose primary purpose is to deliver social and environmental benefit. They constitute a fourth sector of the economy, which has been growing at the intersection of the traditional private, public and nonprofit sectors for decades.

CARE Enterprises collaborates with other organizations to support and scale for-benefit enterprises. CARE Enterprises is participating in the Fourth Sector Development Initiative (FSDI), a newly formed multi-stakeholder initiative of the World Economic Forum Global Future Council on International Governance, Public-Private Cooperation and Sustainable Development in partnership with the Fourth Sector Group. FSDI brings together public, private and philanthropic institutions committed to catalysing trillions of dollars of fourth sector growth by 2030 through fostering the enabling ecosystem required for for-benefit enterprises to flourish.

“CARE has had great success as the founder of MicroVest and Small Enterprise Assistance Fund (SEAF) which together have about $800 million in assets under management today – capital being put to very good service. Having learned from first generation impact funds, CEI gets creative at the deal structure level, so entrepreneurs can access patient capital that takes into consideration the context in which they operate,” says Bill Unger, vice chair, CARE Enterprises Board of Directors and former managing director, Mayfield Fund.

One of the principal unmet needs of these enterprises is access to capital. Standard investment instruments frequently prioritize the needs of investors (higher financial returns to realize a quick exit) over the needs of for-benefit investees in frontier markets (slower growth inherent with business models built for marginalized communities). For-benefit enterprises focused on economic inclusion in frontier markets operate differently from conventional businesses and therefore need financial partners that will respond appropriately.

CARE Enterprises is stepping forward to meet this need by offering to investees alternative deal structures all along the debt to equity spectrum — impact-based loans, performance-based loans, mezzanine debt, and variable payment dividends — to meet the unique needs of for-benefit entrepreneurs and their companies so they can remain mission-focused and maximize their chances of both social and commercial success. To address and further scale the financial needs of these entrepreneurs and companies, CARE Enterprises is planning to develop and work with new investment vehicles implementing this investment thesis.

“Rather than having these entrepreneurs fit into structures that demand profit-maximization, CARE Enterprises will create a portfolio of transformative ‘benefit-maximizers’ by incentivizing our investees to deliver on their promises of social impact to create dignified jobs that break cross-generational poverty cycles in marginalized communities. This impact thesis is – and will remain – embedded in the core of our investment structures and portfolio,” says Marilia Bezerra, managing partner, CARE Enterprises.

When it comes to creating economic opportunity for those excluded from the economy, particularly in frontier markets, the impact investment community is starting to see that achieving both transformative social impact and market-rate financial returns is the exception, not the norm. “The most impactful and successful of social enterprises in emerging economies — even in developed countries — are likely to generate only low-single-digit financial returns .” In response to this, Bezerra says, “CARE Enterprises is happy to accept lower returns in exchange for transformative impact. We want our legacy to be the scaling up of for-benefit enterprises that break the cycle of poverty. We also want to help open up a conversation about how second generation impact funds can truly help expand the reach of the market to include billions of people experiencing poverty today. In partnership with other like-minded players, we are excited to prove that it is possible to prioritize social impact while also achieving financial returns.”

CARE Enterprises is a for-profit subsidiary of CARE USA, a leading non-profit organization that works around the globe to save lives, defeat poverty and achieve social justice. While CARE is most widely recognized for its long history of development programs that improve the lives and livelihoods of people around the world, what is less commonly known is that CARE is a pioneer in successfully adopting market-based solutions to combat poverty. CARE Enterprises will bring CARE’s deep understanding of the needs of those in poverty and the complex social, political and cultural dynamics unique to each market, and develop a distribution network for growth companies by leveraging CARE’s global footprint and local networks.

CARE Enterprises will help build the fourth sector ecosystem by implementing these innovative investment models and share learnings with the FSDI community to increase knowledge and raise awareness about the fourth sector.

About CARE

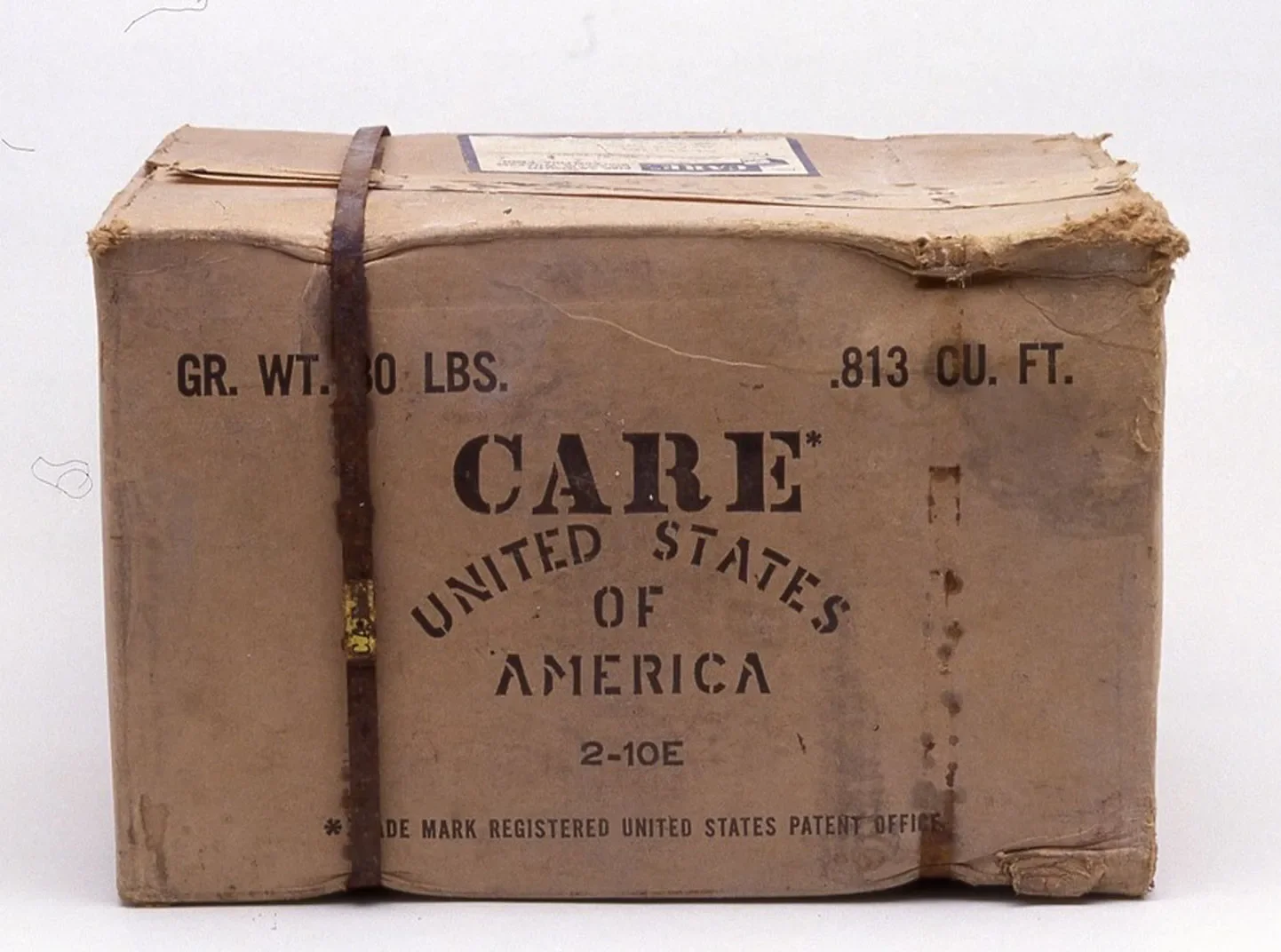

Founded in 1945, CARE is a leading humanitarian organization fighting global poverty. CARE places special focus on working alongside poor girls and women because, equipped with the proper resources, they have the power to lift whole families and entire communities out of poverty. Last year, CARE worked in 94 countries and reached more than 80 million people around the world. Learn more at care.org.

Media Contacts

Rebecca Holliday, rebecca.holliday@care.org