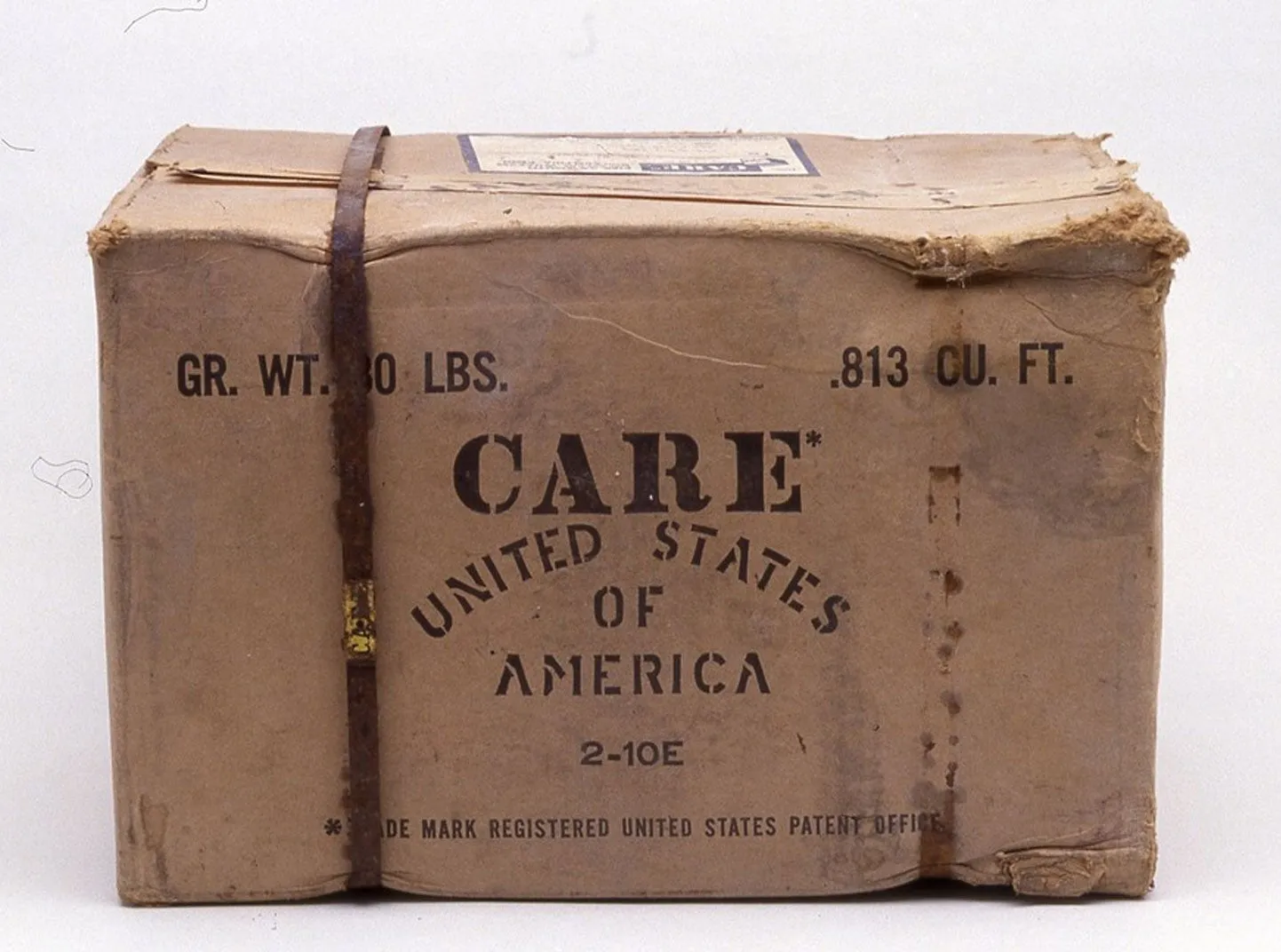

For nearly 80 years, CARE has led the way to a better life for the world’s most at-risk people.

This year, CARE and our partners worked in 121 countries, reaching 58.7 million people through 1,467 projects fighting poverty and responding to emergencies. But famine, conflict, climate disasters, and health crises are making life harder for communities already at risk—especially for women and girls. Bold ideas and urgent action are needed to drive progress for families around the world.

CARE is on the forefront of using crypto donations to save lives.

We are partnering with the crypto community to find new ways to respond to urgent humanitarian emergencies and end poverty. We work every day—using all forms of currency—to make a difference.

Learn more about how your crypto donation can help families around the world by watching the video below.