As impact investors who have launched a new “gender-justice” impact investment fund, CARE wants to make it clear: we seek deep systems change.

CARE— alongside its partners, Bamboo Capital Partners and International Trade Centre’s SheTrades Initiative — have designed the CARE-SheTrades Impact Fund with hopes of moving beyond counting women to tackling root causes of gender discrimination by addressing systemic barriers that keep billions of people from thriving.

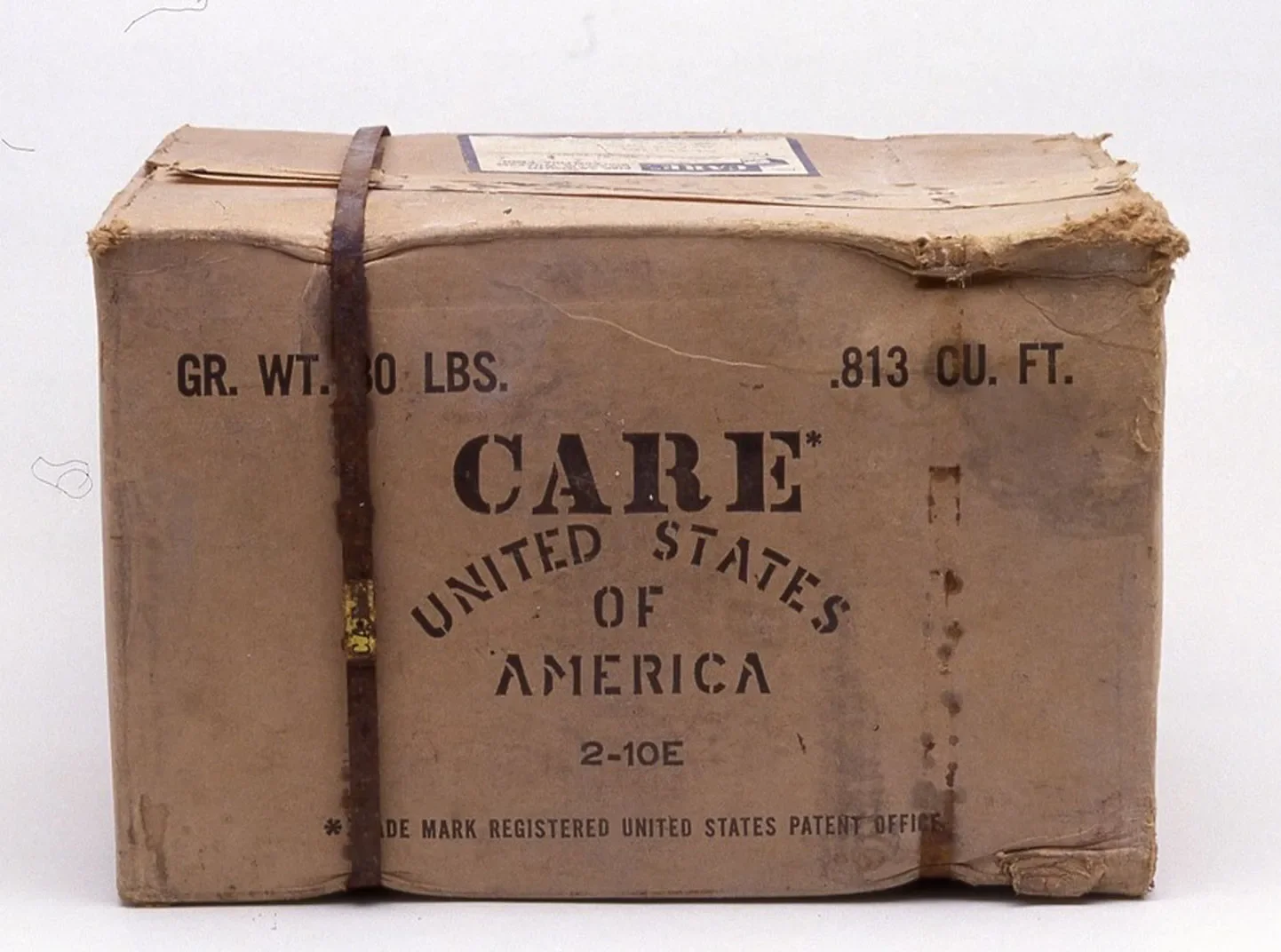

While many early gender-lens approaches focused primarily on investing in women-led businesses or women in senior leadership roles, recent investors have expanded their strategies to create broader and deeper impact for various groups of women all along the value chain. As a fund that is seeded by CARE – an organization with a 75-year history of addressing the structural inequalities of poverty and gender discrimination – we seek to contribute to the further evolution of the gender-lens industry by applying the important lessons CARE has learned from its unique, on-the-ground experience to an early-stage investment strategy.

CARE has committed $10 million to fund, with at least $5 million for first-loss capital. We have raised additional capital from institutional investors, including USAID, and high-net worth individuals. The fund will deploy much-needed capital and robust technical assistance to integrate gender equality into enterprises that are committed to positively impact their women employees, consumers and supply-chain businesses in emerging markets in South and Southeast Asia.

By putting its money and gender expertise to work, the fund’s investment strategy aims to create strong financial growth for companies while improving economic inequities women face by:

• Creating a safe, gender-inclusive workplace through the elimination of sexual harassment and gender-based violence;

• Ensuring dignified work through equitable and just workplace policies and practices that value both women and men equally;

• Promoting economic prosperity for women consumers through access to critical products/services; and

• Increasing the participation of women-led businesses and producers in the supply chain of the fund’s portfolio businesses.

Gender justice

A close examination of the lessons CARE has learned from its long history of effective gender-justice programming has brought to light four principles that we have applied to our investment strategy to help us achieve meaningful structural change for marginalized women in the markets where we invest:

1. Address unconscious bias in the company. We believe that unconscious gender bias is embedded in customs, mindsets and habits of the people who run companies and that this sets the tone and culture within the business. The attitude demonstrated by leaders is often reflected in the formal systems and informal practices of the company.

To overcome this bias, the fund’s separate Technical Assistance Facility – staffed by local CARE gender experts – will support context and culture-appropriate gender and diversity unconscious bias training for company leaders and staff. These attitude and behavioral changes can help shape the culture of diversity and inclusion in the company, which we believe are critical to achieving gender equality. We will be tracking how this support builds the scaffolding for a cultural shift in a company, towards overcoming gender bias in the investee company’s policies and practices, whether in recruitment and staff advancement, development of company products and services, or related to the sourcing and support of supply chains.

2. Incorporate women’s input in company decisions. Our goal is to incorporate the leadership and feedback of women into the company’s decisions. We believe that a business that is able to tap into the wisdom of its diverse employees, consumers and suppliers will be more market responsive and will lead to a stronger company and higher impact. Our local CARE gender and business experts will deliver technical assistance based on an understanding of the local community, language, and business environments.

The technical assistance they provide will use tools and approaches drawn from CARE’s community-based experiences, including community listening processes, feedback loops, business-based governance and problem-solving techniques to ensure that business practices are hearing all relevant voices. Through this process, we hope to learn new approaches and ways businesses can incorporate women’s ideas, and test whether culturally and contextually appropriate training, tools, and coaching for improved gender-responsive feedback loops can accelerate business growth.

3. Create systemic change by addressing implicit and explicit inequities. We believe that deep, systemic impact can only be achieved and sustained by tackling three levels of change: implicit, semi-explicit, and explicit. The first principle focuses on the implicit through addressing mental modes (attitudes, unconscious bias) and the second focuses on the semi-explicit by attempting to shift unequal power dynamics by integrating the voices of those who are often ignored in business decisions. Through our investments and technical assistance, we will facilitate and encourage companies to use these lessons to also create explicit change through the design of new policies, practices and business solutions.

This may influence how their products and services are marketed and delivered to have a greater impact on the economic prosperity of their women consumers. Or perhaps it might inform new ways to shape value-chain partnerships that reach women in and outside the company’s immediate mandate, achieving impact on a larger scale. Through this multi-level systemic change, we hope to learn how shifting a business’ implicit, inequitable conditions can also generate more effective, impactful business approaches, both for the company’s bottom-line and for their women employees, customers, or supply chain business-owners.

4. Walk the talk: impact carry. Because achieving impact for women is of equal importance to achieving the fund’s target financial return for investors, the fund team has created an innovative incentive structure that directly aligns its “carried interest” (i.e. fund profit) to the achievement of both impact and financial results. Half of the profit will be tied to reaching the fund’s Invested Rate of Return (IRR) and the other half to reaching our ambitious gender impact goals.

Achieving impact as outlined in the first three principles is a more complex and uncertain endeavor than hitting a desired financial hurdle. It is therefore unsurprising that most impact funds have not yet fully embraced tying compensation to their impact strategies. However, we strongly believe in leading by example and hope our model can demonstrate how to implement a quantifiable, clear set of metrics in a performance dashboard that will keep us focused on impact throughout the investment process and hold us accountable to achieve the systemic change we set out to accomplish.

Deep problems, deep solutions

Why focus on gender-justice? The numbers speak for themselves. Despite rapid economic growth in many parts of the world, women continue to lag behind their male counterparts in economic prosperity. They are more likely to work in insecure, low-wage jobs in the informal economy, have less access to finance, and face more barriers to starting, running, or advancing in business. In addition, women are paid less than men in equivalent positions, and experience more sexual harassment and violence, both in the workplace and at home.

What’s behind these dismal statistics? Deeply entrenched attitudes, social structures and inequitable systems continue to keep many women at a disadvantage; and with the disproportionate effect that COVID-19 is having on women and girls around the world, we know that the compounding complexities of the global pandemic will only further exacerbates these disparities.

We understand that these are deep problems that require deep solutions. Our strategy is founded on the belief that private sector business leaders can and will embrace the opportunity to apply inclusive – or “gender-smart” – business practices that address gender inequality, not only because it’s the right thing to do, but because it is likely to enhance economic value for the company. Data shows that equal representation by women and men in business— and eliminating all forms of discrimination against female workers and managers— can increase profitability, productivity, and effectiveness, productivity per worker by 40%. And a 2019 analysis found that the top 25% of gender-diverse executive teams were 25% more likely to have above-average profitability and the most diverse companies are 36% more profitable than the least diverse teams.

With performance like this, more and more investors are starting to look towards companies’ commitments to gender equality as an indicator of future growth. Recent research of the global gender-lens investment market shows that the number of investors that apply a gender-lens to their strategies has grown from 58 in 2017 to 138 in 2019, with gender-lens assets-under-management quadrupling from $1.1b in 2017 to $4.8b within those two years.

Even with the compelling opportunity for economic gains, the question remains: How can systemic barriers underlying gender inequality be addressed in a way that businesses can adopt and embed in their business models? Recent social movements like #MeToo and Black Lives Matter show that dismantling structural inequalities is not easy work and moving beyond superficial solutions to systemic change requires a thoughtful and principled approach.

As the gender-lens investment market continues to mature, the global impact community must consider what more it can do to achieve critical structural change. We recognize this challenge and offer the above four principles in the hopes that other investors find them useful as they design their own strategies that strive for more meaningful impact. As part of our continued commitment to help further the evolution of the field, we plan to share our hypotheses, approaches, and learnings with our colleagues – and the broader industry – as we navigate how to grow and strengthen businesses while also accomplishing bold, holistic and systemic improvements that increase women’s value, wealth, and access to economic opportunities through this new, transformative gender-lens strategy.

The $75 million gender-justice CARE-SheTrades Impact Fund will deploy both debt and equity capital to growth stage companies that are creating value for women as employees, consumers and business owners in South and Southeast Asia. The fund is a partnership between CARE Enterprises Inc., Bamboo Capital Partners and International Trade Centre, She Trades.

Ayesha Khanna is managing director and Virginia Schippers is director of investments and impact with CARE Enterprises Inc.. Doris Bartel is the former head of CARE’s Global Gender Justice team. Interested in learning more? Contact virginia@ceigrowthfund.com.