March 18 media event in Accra will share vision of this innovative financial inclusion program, which is bringing full-service mobile banking to remote communities in West Africa

ACCRA, Ghana (March 18, 2014) — The international poverty fighting organization CARE, with a grant from Visa Inc, has launched a program in Ghana with mobile communications company MTN and Fidelity Bank that is offering community savings groups in remote areas access to full-service banking using mobile phones.

On March 18 at 10:00 A.M. at the Alisa Hotel in Accra, representatives from CARE, Visa Inc, MTN and Fidelity will meet with the media and public to answer questions about this innovative group mobile banking system in West Africa.

CARE’s community savings groups (known as Village Savings & Loan Associations or VSLAs) in the Amansie West District in the Ashanti region are now able to open and operate a Fidelity Bank Smart Account without visiting a physical bank branch. VSLA groups can quickly open bank accounts by visiting a Fidelity Smart Agent found in local neighborhood convenience shops, pharmacies, markets and utility payment vendors. With the approval of the Bank of Ghana, Fidelity Smart Agents can now open bank accounts remotely using only a valid Ghanaian identification card. With its unique group functionality, Fidelity Smart Accounts allow CARE VSLA groups to withdraw and deposit money, earn interest on savings, make payments, transfer money and get account statements using mobile phones on the MTN mobile phone network.

“Fidelity Bank and MTN’s commitment to ensuring that anyone who wants a bank account can have one has yielded impressive results,” says Lauren Hendricks, executive director of CARE’s Access Africa program. “To open an account, representatives from a CARE VSLA need only visit a Fidelity Smart Bank agent in their village. The agent snaps photos of their identification cards and sends it over the MTN mobile network to a processing agent. Within five minutes, the remote processing agent opens the account. It’s a secure, convenient system that’s among the first of its kind in West Africa. In rural farming communities that are hours, if not days, from the nearest bank branch, this technology is a game-changer.”

Commenting on this innovative system in West Africa, the Managing Director of Fidelity Bank Edward Effah says Fidelity is strongly committed to financial inclusion in Ghana and supports programs to help the unbanked and under-banked see the full benefits of banking products and services.

“We have designed and developed client-centric products with convenient channels to ensure that the unbanked and under-banked receive the best service suited for their needs,” Effah says.

Visa’s grant with CARE is designed to drive financial inclusion in Ghana by helping CARE reach more of the unbanked and to transition its traditional cash-based savings and loan model to one that utilizes convenient and secure electronic payments.

“Informal savings and loan groups provide all sorts of benefits to their members, including financial literacy training,” says Stephen Kehoe, head of global financial inclusion, Visa Inc. “By moving away from cash and connecting people to formal financial services via tools like mobile money, VSLAs have the potential to reduce risks for members, improve program efficiencies and truly drive scale.”

“There is tremendous unmet demand for banking services across Ghana and across West Africa,” says Helene Gayle, president and CEO of CARE. “We are pleased to be working with Visa, Fidelity Bank and MTN, all of whom have shown deep commitment to designing products and services to reach people in the poorest communities.”

About CARE

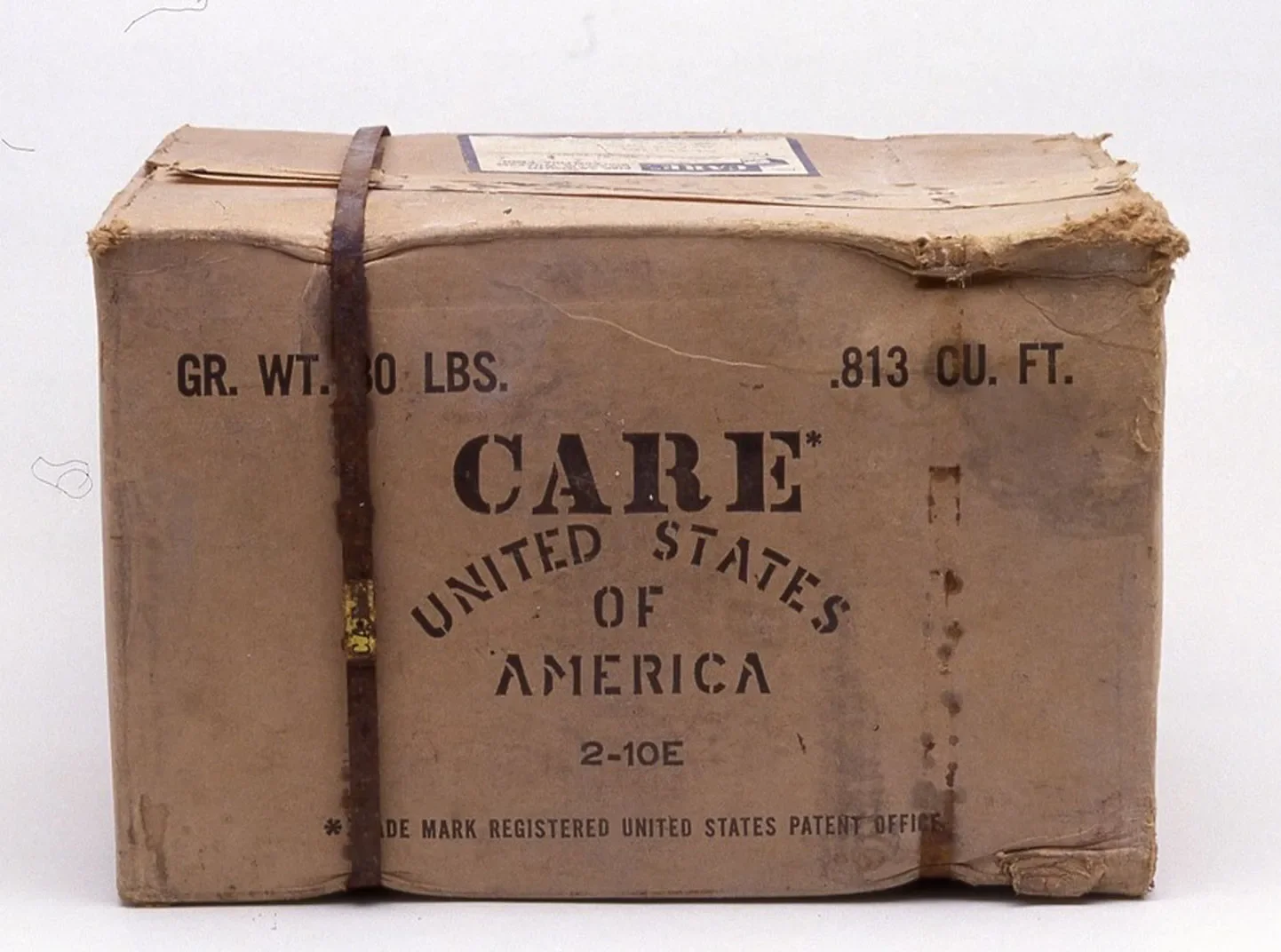

CARE brings financial services to more people in Africa than any other international non-governmental organization. Through its unique savings-led approach, CARE’s Access Africa program has reached more than 3 million people in 26 countries in sub-Saharan Africa. Founded in 1945 with the creation of the CARE Package®, CARE is a leading humanitarian organization fighting global poverty. CARE places special focus on working alongside poor girls and women because, equipped with the proper resources, they have the power to lift whole families and entire communities out of poverty.

Our six decades of experience show that when you empower a girl or woman, she becomes a catalyst, creating ripples of positive change that lift up everyone around her. That’s why girls and women are at the heart of CARE’s community-based efforts to improve education, health and economic opportunity for everyone. We also work with girls and women to promote social justice, respond to emergencies and confront hunger and climate change. Last year CARE worked in 84 countries and reached more than 83 million people around the world. To learn more, visit www.care.org.