Give now from your

Donor-Advised Fund

A donor-advised fund (DAF) is a type of giving fund administered by a third party that allows you to combine favorable tax benefits with the flexibility to easily support CARE. It is created to manage your charitable donations.

An increasingly popular charitable vehicle, DAFs provide a way to simplify your charitable giving. DAFs allow you to give cash, stock and other assets and receive a tax deduction when the contribution is made. Then, you may use the fund to grant specific amounts to CARE over time.

How it works

- Establish your donor-advised fund by making an irrevocable, tax-deductible donation to an organization that sponsors a DAF program, such as Fidelity Charitable, National Philanthropic Trust, or your local community foundation.

- Determine the investment allocation of the donated assets (any investment growth is tax-free).

- Recommend grants to Cooperative for Assistance and Relief Everywhere, Inc. (CARE) whenever you wish to make a gift. We advise entering CARE’s full legal name or employer identification number (EIN) 13-1685039 when searching a DAF charity database. The address for CARE’s Gift Center is P.O. Box 1870, Merrifield, VA 22116, and our headquarters are located at 151 Ellis Street NE, Atlanta, GA 30303.

What can my donor-advised fund do for CARE?

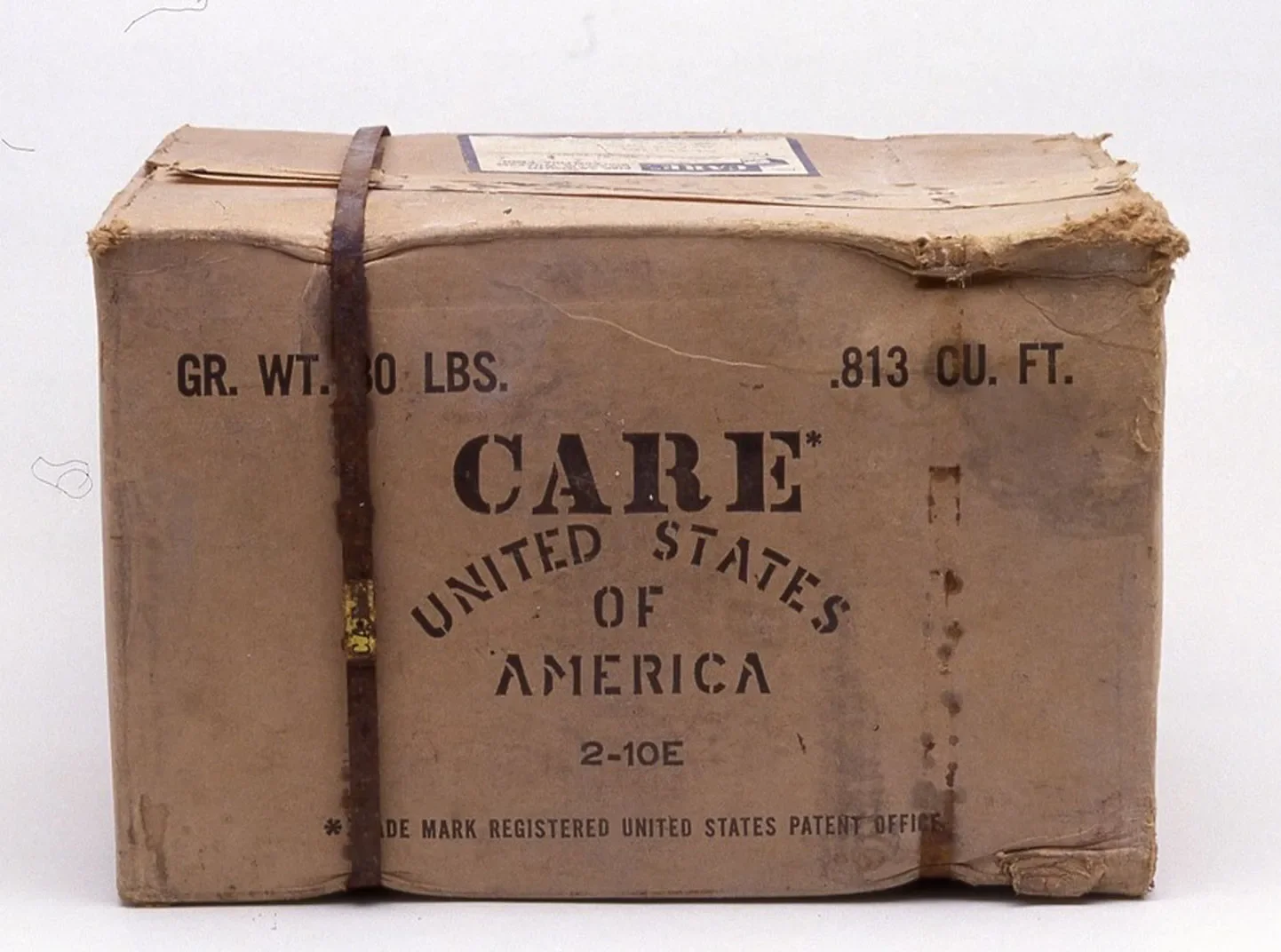

DAFs provide a flexible, low-cost method of giving support for our work our work worldwide. These gifts are an essential part of the lasting change we make in the lives of vulnerable people as we empower them to defeat poverty.

You may also name CARE as the beneficiary of the fund during your estate and legacy planning. Learn how to include CARE in your will, estate plans, or give other planned gifts.

Contact information

To learn more about making a gift to CARE using your donor-advised fund, please contact us at Alejandra.Villalobos@care.org.